VALUATION WATCH: Overvalued stocks now make up 30.68% of our stocks assigned a valuation and 8.9% of those equities are calculated to be overvalued by 20% or more. Two sectors are calculated to be overvalued.

With the big sell off yesterday, we now calculate that 30.68% of stocks are overvalued and 8.9% of those stocks are overvalued by 20% or more. This is a huge reversal of where we have been for much of the year. In fact, to find stocks calculated to be this "cheap," you would have to go all the way back to November, 2012.

Given the state of the US economy, and the fact that this slide in prices makes the potential for a Fed rate-hike next month less likely in our view, we believe this dip represents a buying opportunity for investors.

For today's bulletin we searched for top-rated stocks that were significantly undervalued despite having strong forecast figures. These stocks are shown below, and presented in alphabetical order.

The list is heavy with transportation firms of the bulk shipping variety. These can present a mixed bag for the investor. On the one hand, one could argue that a poor prognosis for China will hurt shippers, since they often carry commodities to or from that nation. A poor outlook for steel, copper, coal, oil, etc. can hurt these firms. On the other hand, speculators may use giant cargo ships to hold commodities in the hopes of securing more favorable pricing for their goods.

Additional research is essential to discern how a particular shipper is positioned to deal with these sorts of issues. Many professional investors use indices such as the Baltic Dry Index (BDIY) as a leading indicator for the world economy--much as the Dow Jones Transportation are used for making calls about the future of the US economy and the overall DOW. It is worthwhile to note that the BDIY has been declining steeply over the past few weeks as shipping rates have declined significantly.

Top stocks from today's screen are as follows:

Avid Technology Inc (NASDAQ:AVID), DHT Holdings Inc (NYSE:DHT), Starz A (NASDAQ:STRZA), Teekay Tankers Ltd (NYSE:TNK), and Tsakos Energy Navigation Ltd (NYSE:TNP)

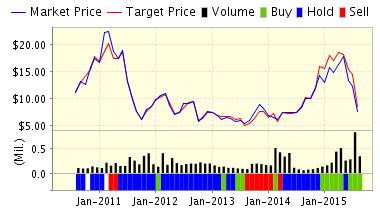

Below is today's data on AVID:

Avid Technology, Inc. (AVID) develops, markets, sells and supports a wide range of software and systems for creating and manipulating digital media content. Digital media are media elements, whether video or audio or graphics, in which the image, sound or picture is recorded and stored as digital values, as opposed to analog signals. The company's systems are designed to improve the productivity of video and film editors by enabling them to edit moving pictures and sound in a faster, easier, and more cost-effective manner than traditional analog tape-based systems.

VALUENGINE RECOMMENDATION: ValuEngine continues its STRONG BUY recommendation on AVID TECH INC for 2015-08-24. Based on the information we have gathered and our resulting research, we feel that AVID TECH INC has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Earnings Growth Rate and P/E Ratio.